UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14C INFORMATION

Information Statement Pursuant to Section 14(c) of the

Securities Exchange Act of 1934

Check the appropriate box:

o | Preliminary Information Statement |

o | Confidential, for Use of the Commission Only (as permitted by Rule 14c-5(d)(2)) |

x | Definitive Information Statement |

BioCorRx Inc. |

(Name of Registrant As Specified in Charter) |

Payment of Filing Fee (Check the appropriate box):

x | No Fee required. |

o | Fee computed on table below per Exchange Act Rules 14c-5(g) and 0-11. |

(1) | Title of each class of securities to which transaction applies: | |

(2) | Aggregate number of securities to which transaction applies: | |

(3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |

(4) | Proposed maximum aggregate value of transaction: | |

(5) | Total fee paid: |

o | Fee paid previously with preliminary materials |

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

(1) | Amount Previously Paid: | |

(2) | Form, Schedule or Registration Statement No.: | |

(3) | Filing Party: | |

(4) | Date Filed: |

BioCorRx Inc.

601 N. Parkcenter Drive

Suite 103

Santa Ana, California 92705

Dear Stockholders:

We are writing to advise you that our Board of Directors (the "Board") and stockholders holding a majority of the outstanding shares of our voting capital stock (the "Majority Holders") have approved an amendment to our Articles of Incorporation (the "Amended Articles") to increase the number of shares of common stock and preferred shares authorized for issuance.

This action was approved by written consent on May 13, 2016 by our Board and by the Majority Holders. Our directors and the Majority Holders, as of the record date of the close of trading on May 12, 2016, have approved the Amended Articles as they determined that it was in the best interest of the Company and its stockholders.

WE ARE NOT ASKING YOU FOR A PROXY, AND YOU ARE REQUESTED NOT TO SEND US A PROXY.

No action is required by you. Pursuant to Rule 14(c)-2 under the Securities Exchange Act of 1934, as amended, the proposals will not be effective until at least twenty (20) calendar days after the date this Information Statement has been mailed to our stockholders. This Information Statement is first mailed to you on or about June 9, 2016.

For the Board of Directors | |||

By: | /s/ Brady Granier | ||

Brady Granier | |||

Interim Chief Executive Officer, Chief | |||

| 2 |

BIOCORRX INC.

601 N. Parkcenter Drive

Suite 103

Santa Ana, California 92705

INFORMATION STATEMENT REGARDING

ACTION TO BE TAKEN BY WRITTEN CONSENT OF

MAJORITY STOCKHOLDERS

IN LIEU OF A SPECIAL MEETING

PURSUANT TO SECTION 14(C) OF THE

SECURITIES EXCHANGE ACT OF 1934

WE ARE NOT ASKING YOU FOR A PROXY,

AND YOU ARE NOT REQUESTED TO SEND US A PROXY

GENERAL

This Information Statement is being furnished to all holders of the common stock and preferred stock of BioCorRx Inc. (the "Company") as of the close of trading on May 12, 2016 (the "Record Date"), in connection with the action taken by written consent of the Majority Holders to authorize the Amended Articles.

"We," "us," "our," the "Registrant" and the "Company" refers to BioCorRx Inc., a Nevada corporation.

SUMMARY OF CORPORATE ACTIONS

INFORMATION STATEMENT

This Information Statement is furnished to the stockholders of the Company, in connection with our prior receipt of approval by written consent, in lieu of a special meeting, of the Majority Holders approving and Amended Articles.

On May 13, 2016, the Company obtained the approval of the Amended Articles by the Board and by written consent of the Majority Holders that are the record owners of 127,049,510 shares of common stock and 70,000 shares of Preferred Stock representing 70,000,000 voting shares, which represents an aggregate of approximately 51.77% of the voting power as of the close of trading on the Record Date. The names of the Majority Holders of record who hold in the aggregate a majority of our total issued and outstanding common stock and who signed the written consent of stockholders are:

Shareholder |

| Shares of Common Stock Voting |

|

| Shares of Preferred Stock Voting |

|

| Total Percentage Voting Percentage* |

| |||

Neil Muller |

|

| 8,400,000 |

|

|

| 20,000,000 |

|

|

| 11.57 | % |

Felix Financial Enterprise LLC |

|

| 2,500,000 |

|

|

|

|

|

|

| 1.02 | % |

Lourdes Felix |

|

|

|

|

|

| 10,000,000 |

|

|

| 4.08 | % |

Kent Emry |

|

| 7,042,000 |

|

|

| 10,000,000 |

|

|

| 6.94 | % |

Brady Granier |

|

| 7,421,900 |

|

|

| 10,000,000 |

|

|

| 7.10 | % |

Global Finance PTY |

|

| 11,130,000 |

|

|

|

|

|

|

| 4.54 | % |

FSP (QLD) PTY LTD |

|

| 3,839,000 |

|

|

|

|

|

|

| 1.56 | % |

Jorge Andrade |

|

| 7,671,921 |

|

|

| 10,000,000 |

|

|

| 7.20 | % |

Karle Grothe |

|

| 1,805,000 |

|

|

|

|

|

|

| 0.74 | % |

George Fallieras |

|

| 4,654,750 |

|

|

|

|

|

|

| 1.90 | % |

Tom Welch |

|

| 2,584,939 |

|

|

| 10,000,000 |

|

|

| 5.13 | % |

Total: |

|

| 127,049,510 |

|

|

| 70,000,000 |

|

|

| 51.77 | % |

___________

*Based on 165,394,501 shares of Common Stock outstanding and 80,000 shares of Preferred Stock outstanding (representing 80,000,000 voting shares) as of the close of trading on the Record Date, which represents 245,394,501 voting shares in the aggregate.

| 3 |

The Amended Articles cannot be effectuated, and filed with the Nevada Secretary of State until twenty (20) days after the mailing of this Information Statement.

The date on which this Information Statement will be sent to stockholders will be on or about June 9, 2016 and is being furnished to all holders of the common stock of the Company on record as of the close of trading on the Record Date.

The Board, and Majority Holders have unanimously approved the Amended Articles. No other votes are required or necessary.

VOTE REQUIRED

A vote by Majority Holders through written consent is required to effect the Amended Articles. As of the Record Date, the Company had 245,394,501 voting shares of common stock and preferred stock issued and outstanding. The consenting stockholders of the shares of common stock and preferred stock are entitled to 197,049,510 votes, which represent approximately 51.77% of the voting rights associated with the Company's shares of common stock. The consenting stockholders voted in favor of the Amended Articles described herein in a unanimous written consent dated May 13, 2016.

APPROVAL OF AN AMENDMENT TO THE ARTICLES OF INCORPORATION TO INCREASE

THE AUTHORIZED SHARES OF COMMON STOCK AND PREFERRED STOCK OF THE COMPANY

Approval of the Amended Articles

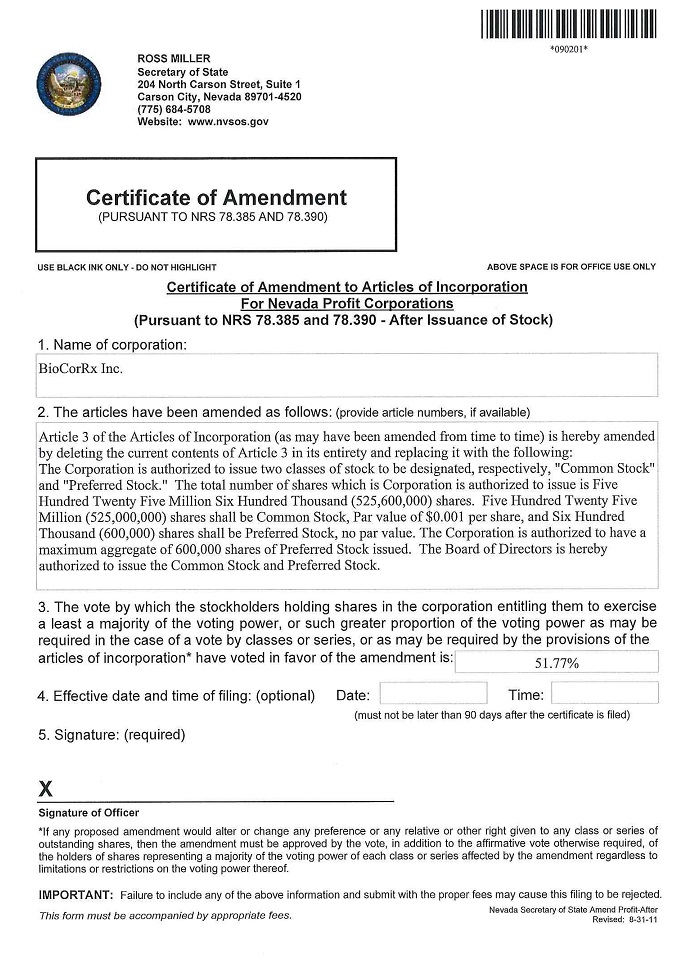

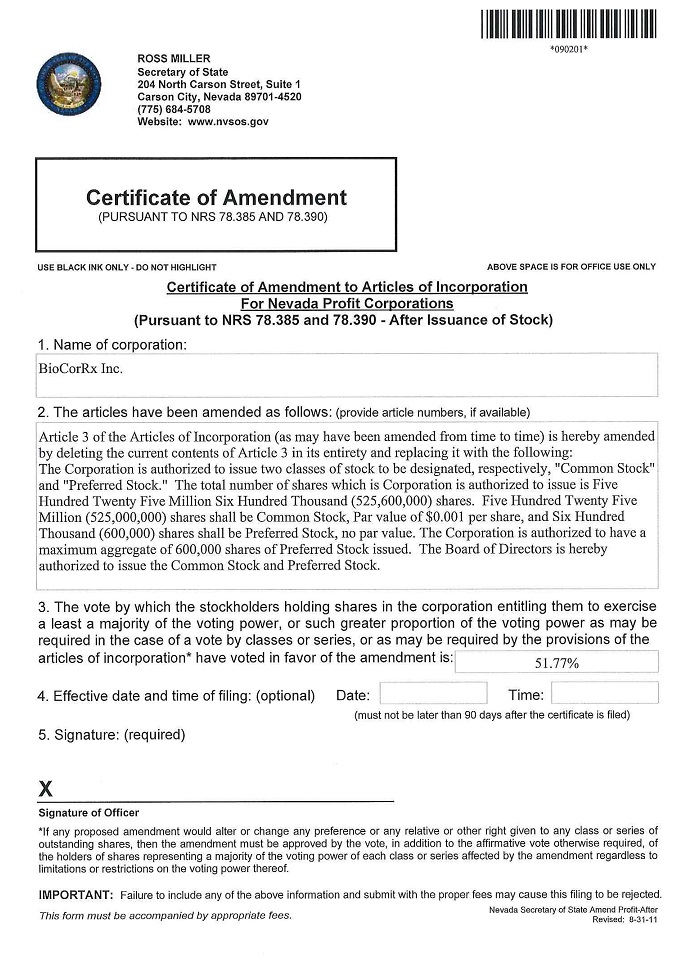

The Board approved the Amended Articles on May 13, 2016, and the Majority Holders approved the Amended Articles on May 13, 2016, to increase our authorized shares of Common Stock from 200,000,000 to 525,000,000 and our authorized shares of Preferred Stock from 80,000 to 600,000. The increases in our authorized shares of Common Stock and Preferred Stock will become effective upon the filing of the Amended Articles to the Articles of Incorporation with the Secretary of State of the State of Nevada. We will file the Amended Articles to effect the increases in our authorized shares of Common Stock and Preferred Stock approximately (but not less than) 20 days after this definitive information statement is mailed to stockholders.

Outstanding Shares and Reasons for the Amended Articles

The Company's Articles of Incorporation, as amended, have authorized the Company to issue a maximum of 200,000,000 shares of Common Stock, par value $0.001 per share, and 80,000 shares of Preferred Stock, no par value. As of the close of trading on the Record Date, we had approximately 165,394,501 shares of Common Stock issued and outstanding and 80,000 shares of Preferred Stock issued and outstanding.

The Board believes that the increase in our authorized Common Stock and Preferred Stock will provide the Company greater flexibility with respect to the Company's capital structure and that it is in the Company's best interest to have additional shares of common stock and preferred stock authorized for purposes of effectuating future capital raises and for general corporate purposes, including but not limited to establishing strategic relationships with other companies, the issuance of shares upon conversion of existing or future equity derivative securities and compensating certain service providers to the Company. If the Amended Articles were not approved, the Company's ability to engage in these types of transactions would be severely limited or delayed.

| 4 |

Effects of the Amended Articles

The additional shares of Common Stock will have the same rights as the presently authorized shares, including the right to cast one vote per share of Common Stock. The additional shares of Preferred Stock will have the same rights and privileges as previously designated to such shares, including the right to cast 1,000 votes per share of Preferred Stock and the right to convert one share of Preferred Stock into one share of Common Stock.

Although the authorization of additional shares of Common Stock and Preferred Stock will not, in itself, have any effect on the rights of any holder of our Common Stock or Preferred Stock, the future issuance of additional shares of Common Stock or Preferred Stock (other than by way of a stock split or dividend) would have the effect of diluting the voting rights and could have the effect of diluting earnings per share and book value per share of existing stockholders. It is possible that some of these additional shares could be used in the future for various corporate purposes without further stockholder approval, except as such approval may be required in particular cases by our charter documents, applicable law or the rules of any stock exchange or other quotation system on which our securities may then be listed. These purposes may include: raising capital, providing equity incentives to employees, officers or directors, establishing strategic relationships with other companies, and expanding the Company's business or product lines through the acquisition of other businesses or products

The above description of the Amended Articles is qualified in its entirety by the actual text of the Amended Articles, which is set forth in Exhibit A (subject to any changes required by applicable law) to this Information Statement.

Effective Time of the Amended Articles

We intend to file, as soon as practicable on or after the twentieth (20th) day after this Information Statement is sent to our stockholders, the Amended Articles with the Secretary of State of Nevada. The Amended Articles to our Articles of Incorporation will become effective at the close of business on the date the Amended Articles is accepted for filing by the Secretary of State of Nevada. It is presently contemplated that such filing will be made approximately twenty (20) days from the date that this Information Statement is sent to our stockholders. The text of the Amended Articles is subject to modification to include such changes as may be required by the Nevada Secretary of State to effectuate the Amended Articles.

Dissenters' Right of Appraisal

No dissenters' or appraisal rights under the Nevada law, the Company's Articles of Incorporation or Bylaws, are afforded to the Company's stockholders as a result of the approval of the action.

BOARD AND SHAREHOLDER APPROVAL

Our directors and holders of approximately 51.77% of our voting power signed written consents in favor of the Amended Articles. The Amended Articles will be effective upon the filing of the Amended Articles with the Secretary of State of the State of Nevada, which is expected to occur as soon as reasonably practicable on or after the twentieth (20th) day following the mailing of this Information Statement to stockholders.

The information contained in this Information Statement constitutes the only notice we will be providing stockholders.

| 5 |

DESCRIPTION OF SECURITIES

Description of Common Stock and Preferred Stock

Number of Authorized and Outstanding Shares

The Company's current Articles of Incorporation authorizes the issuance of 200,000,000 shares of common stock, par value $0.001 per share, of which 165,394,501 shares were outstanding as of the close of trading on the Record Date. All of the outstanding shares of common stock are fully paid and non-assessable. The Company's current Articles of Incorporation authorizes the issuance of 80,000 shares of preferred stock, par value $0.001 per share, of which 80,000 shares were outstanding as of the close of trading on the Record Date.

Voting Rights

Holders of shares of common stock are entitled to one vote for each share held of record and holders of shares of preferred stock are entitled to one thousand (1,000) votes for each share of preferred stock held of record on all matters to be voted on by the stockholders. Accordingly, the holders of in excess of 50% of the aggregate number of shares of common stock and preferred stock entitled to vote will be able to approve or disapprove any matter submitted to a vote of all stockholders. The holders of our common stock and preferred stock are entitled to receive ratably such dividends, if any, as may be declared by the Board out of funds legally available. We have not paid any dividends since our inception, and we presently anticipate that all earnings, if any, will be retained for development of our business. Any future disposition of dividends will be at the discretion of our Board and will depend upon, among other things, our future earnings, operating and financial condition, capital requirements, and other factors.

Other

Holders of common stock have no cumulative voting rights. Holders of common stock have no preemptive rights to purchase the Company's common stock. There are no conversion rights or redemption or sinking fund provisions with respect to the common stock.

Holders of common stock have the same rights and privileges and rank equally, share ratably and shares of preferred stock are identical in all respects as to all matters with the Company's common stock, except each share of preferred stock shall entitle the holder to one thousand (1,000) votes and is convertible into one share of common stock.

Transfer Agent

Shares of common stock are registered at the transfer agent and are transferable at such office by the registered holder (or duly authorized attorney) upon surrender of the common stock certificate, properly endorsed. No transfer shall be registered unless the Company is satisfied that such transfer will not result in a violation of any applicable federal or state security laws. The Company's transfer agent for its common stock is VStock, LLC, 18 Lafayette Pl, Woodmere, NY 11598.

| 6 |

VOTE REQUIRED FOR APPROVAL

The Board approved the Amended Articles and based upon the unanimous recommendation and approval by the Board, the Majority Holders approved the Amended Articles. The securities that are entitled to vote to approve the Amended Articles consist of issued and outstanding shares of the Company's common stock, $0.001 par value, and preferred stock, no par value, outstanding as of the close of trading on the Record Date.

VOTING SECURITIES AND PRINCIPAL HOLDERS THEREOF

The Board fixed the close of trading on May 12, 2016 as the record date for the determination of the common stockholders entitled to notice of the action by written consent.

At the Record Date, the Company had 200,000,000 shares of common stock authorized with a stated par value of $0.001, of which 165,394,501 shares of common stock were issued and outstanding. The holders of shares of common stock are entitled to one vote per share on matter to be voted upon by stockholders.

At the Record Date, the Company had 80,000 shares of preferred stock authorized with no par value, of which 80,000 shares of preferred stock were issued and outstanding. The holders of shares of preferred stock are entitled to one thousand (1,000) votes per share on matter to be voted upon by stockholders.

The holders of shares of common stock and preferred stock are entitled to receive pro rata dividends, when and if declared by the Board in its discretion, out of funds legally available therefore.

Dividends on the common stock are declared by the Board. Payment of dividends must comply with the provisions of the Nevada Revised Statutes and will be determined by the Board. In addition, the payment of any such dividends will depend on the Company's financial condition, results of operations, capital requirements, and such other factors as the Board deems relevant.

Stockholders and the holders of a controlling interest equaling approximately 51.77% of the voting power of the Company, as of the Record Date, have consented to the Amended Articles. The stockholders have consented to the action required to adopt the Amended Articles, above. This consent was sufficient, without any further action, to provide the necessary shareholder approval of the action.

| 7 |

SECURITY OWNERSHIP OF EXECUTIVE OFFICERS, DIRECTORS

AND FIVE PERCENT STOCKHOLDERS

The following table sets forth certain information concerning the ownership of the Company's common stock as of the close of trading on the Record Date with respect to: (i) each person known to the Company to be the beneficial owner of more than five percent (5%) of the Company's common stock; (ii) all directors; and (iii) directors and executive officers of the Company as a group. The notes accompanying the information in the table below are necessary for a complete understanding of the figures provided below. As of the close of trading on the Record Date, there were 165,394,501 shares of common stock issued and outstanding.

Security Ownership of Certain Beneficial Owners

Title of Class |

| Name and Address of Beneficial Owner |

| Amount and Nature of Beneficial Ownership |

|

| Percent of Stock (1) |

| |||

|

|

|

|

|

|

|

|

| |||

Directors and Executive Officers (2) |

|

|

|

|

|

|

|

| |||

Common Stock |

| Neil Muller |

|

| 8,400,000 |

|

|

| 5.08 | % | |

Common Stock |

| Brady Granier |

|

| 7,421,900 |

|

|

| 4.49 | % | |

Common Stock |

| Kent Emry |

|

| 7,042,000 |

|

|

| 4.26 | % | |

Common Stock |

| Lourdes Felix (3) |

|

| 2,500,000 |

|

|

| 1.02 | % | |

All directors and executive officers as a group (4 persons) |

|

|

|

| 25,363,900 |

|

|

| 14.85 | % | |

|

|

|

|

|

|

|

|

|

|

| |

5% Holders |

|

|

|

|

|

|

|

|

|

| |

Common Stock |

| Global Finance PTY |

|

| 11,130,000 |

|

|

| 6.73 | % | |

All directors, executive officers and 5% holders as a group (5) |

|

|

|

|

|

|

|

| 21.58 | % | |

______________

(1) | As of the close of trading on the Record Date, we have 165,394,501 shares of common stock outstanding. |

(2) | Each of the directors and executive officers listed also own shares of preferred stock. Mr. Muller holds 20,000 shares of preferred stock and the others each hold 10,000 shares of preferred stock. |

(3) | Ms. Felix, the Company's Chief Financial Officer, is the beneficial owner of 2,500,000 shares held by Felix Financial Enterprise LLC. |

| 8 |

INTEREST OF CERTAIN PERSONS IN MATTERS TO BE ACTED UPON

No director, executive officer, nominee for election as a director, associate of any director, executive officer or nominee or any other person has any substantial interest, direct or indirect, by security holdings or otherwise, in the Amended Articles covered by the related resolutions adopted by the Board, which is not shared by all other stockholders.

FORWARD-LOOKING STATEMENTS

This information statement may contain certain "forward-looking" statements (as that term is defined in the Private Securities Litigation Reform Act of 1995 or by the U.S. Securities and Exchange Commission in its rules, regulations and releases) representing our expectations or beliefs regarding our company. These forward-looking statements include, but are not limited to, statements concerning our operations, economic performance, financial condition, and prospects and opportunities. For this purpose, any statements contained herein that are not statements of historical fact may be deemed to be forward-looking statements. Without limiting the generality of the foregoing, words such as "may,""will,""expect,""believe,""anticipate,""intend,""could,""estimate,""might," or "continue" or the negative or other variations thereof or comparable terminology are intended to identify forward-looking statements. These statements, by their nature, involve substantial risks and uncertainties, certain of which are beyond our control, and actual results may differ materially depending on a variety of important factors, including factors discussed in this and other of our filings with the U.S. Securities and Exchange Commission.

WHERE YOU CAN FIND MORE INFORMATION

We are subject to the information and reporting requirements of the Securities Exchange Act of 1934, as amended, and in accordance with the Securities Exchange Act, we file periodic reports, documents, and other information with the Securities and Exchange Commission relating to our business, financial statements, and other matters. These reports and other information may be inspected and are available for copying at the offices of the Securities and Exchange Commission, 100 F Street, N.E., Washington, DC 20549. Our SEC filings are also available to the public on the SEC's website at http://www.sec.gov.

DELIVERY OF DOCUMENTS TO SECURITY HOLDERS SHARING AN ADDRESS

If hard copies of the materials are requested, we will send only one Information Statement and other corporate mailings to stockholders who share a single address unless we received contrary instructions from any stockholder at that address. This practice, known as "householding," is designed to reduce our printing and postage costs. However, the Company will deliver promptly upon written or oral request a separate copy of the Information Statement to a stockholder at a shared address to which a single copy of the Information Statement was delivered. You may make such a written or oral request by (a) sending a written notification stating (i) your name, (ii) your shared address and (iii) the address to which the Company should direct the additional copy of the Information Statement by sending a written notification to our principal executive offices or by calling our principal executive offices at 714.462.4880.

If multiple stockholders sharing an address have received one copy of this Information Statement or any other corporate mailing and would prefer the Company to mail each stockholder a separate copy of future mailings, you may send notification to or call the Company's principal executive offices. Additionally, if current stockholders with a shared address received multiple copies of this Information Statement or other corporate mailings and would prefer the Company to mail one copy of future mailings to stockholders at the shared address, notification of such request may also be made by mail or telephone to the Company's principal executive offices.

| 9 |

INCORPORATION OF FINANCIAL INFORMATION

We "incorporate by reference" into this Information Statement the information in certain documents we file with the SEC, which means that we can disclose important information to you by referring you to those documents. We incorporate by reference into this information statement the following documents we have previously filed with the SEC: our Annual Report on Form 10-K for fiscal year ended December 31, 2015, our Quarterly Report on Form 10-Q for the quarterly period ended March 31, 2016, and our Current Reports on Form 8-K filed on January 7, 12, 26, and 29, 2016, February 10, 16, and 18, 2016, March 18, 2016, April 18, 2016, and May 20, 2016. You may request a copy of these filings at no cost, by writing or telephoning us at the following address:

BIOCORRX INC.

601 N. Parkcenter Drive

Suite 103

Santa Ana, California 92705

WE ARE NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND US A PROXY. This Information Statement is for informational purposes only. Please read this information statement carefully.

By Order of the Board of Directors | |||

Dated: June 7, 2016 | By: | /s/ Brady Granier | |

Brady Granier | |||

Interim Chief Executive Officer, Chief | |||

10 |

11